How to Create a Smart Investment Portfolio with Abuja Properties

Introduction

Abuja’s real estate market is one of the most profitable and dynamic in Nigeria, attracting local and international investors seeking long-term wealth creation. As the Federal Capital Territory continues to expand with massive infrastructure projects, improved road networks, and growing commercial hubs, property values are rising steadily.

However, buying a single property isn’t enough to maximize returns in today’s competitive market. Savvy investors are turning to smart real estate portfolio strategies—diversifying across land, residential, and commercial properties to balance risks, unlock passive income, and build sustainable wealth.

In this blog, we’ll explore step-by-step strategies, expert insights, and key locations that can help you create a smart investment portfolio with Abuja properties. Whether you’re a first-time buyer or a seasoned investor, these tips will guide you toward making data-backed, profitable decisions in Nigeria’s most promising property market.

How to Create a Smart

1. Define Clear Investment Goals

Begin by identifying what you want from your real estate investments:

– Income vs. Appreciation: Are you targeting steady rental income or long-term capital gains?

– Short, Mid, or Long-Term Vision: Your timeline determines your best-fit property types and areas.

Why it matters: Clarity on these goals will guide your location and asset-type decisions, ensuring every property serves your overall portfolio vision.

2. Diversify Across Property Types and Locations

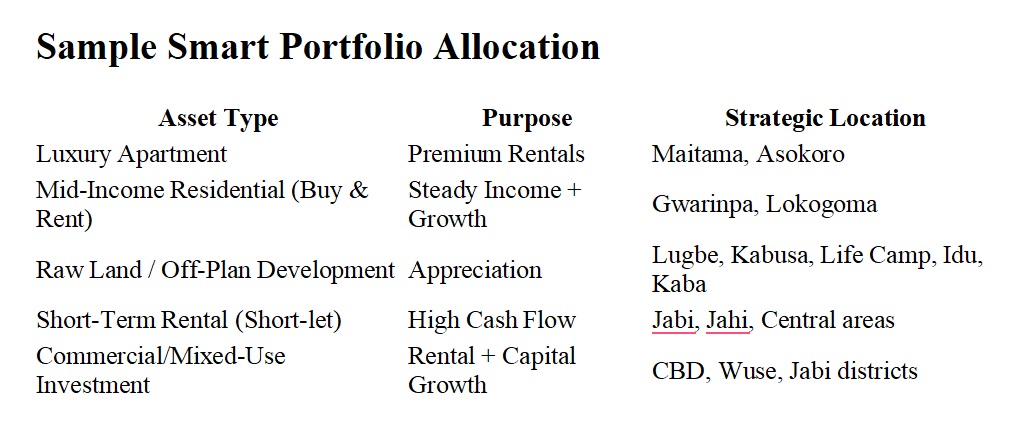

Avoid putting all your capital in a single asset or area. A balanced portfolio may include:

– Luxury Residential (Maitama, Asokoro) – Prestige and reliable demand.

– Mid-Income Housing (Gwarinpa, Lokogoma) – Solid rental yields, strong demand.

– Emerging Land (Lugbe, Idu, Kabusa, Kaba, Gwagwalada, Kuje) – Best for appreciation and land banking

– Commercial or Mixed-Use (Wuse, CBD, Jabi) – Potential for leases and short-lets

– Short-Term Rentals (Jabi, Maitama) – High income from platforms like Airbnb, especially in expat-heavy areas

3. Prioritize Rental Yields and Cash Flow

Understanding current yields helps assess performance:

– Maitama: 6–8% annually — secure and attractive.

– Wuse: 7–10% — strong commercial and residential mix.

– Gwarinpa: 8–10% — affordable yet high-yield investment zone.

Pro Tip: Blend high-yield properties with high-growth but lower-yield assets to balance income and appreciation.

4. Leverage Emerging Hotspots

Smart portfolio building means anticipating growth:

– Satellite Growth Areas: Lugbe, Kuje, Gwagwalada, and Idu are increasingly connected via roads and transit expansions—great for early appreciation.

– Up-and-Coming Districts: Kabusa, Karshi, and Hutu are gaining attention for their affordability and future potential.

These areas can act as high-payoff “growth engines” within your portfolio.

5. Invest Safely with Due Diligence

Ensure each acquisition is legally sound:

– Always insist on FCDA or AGIS-verified title documents – avoid frauds or invalid claims.

– Hire real estate lawyers to scrutinize contracts and titles—don’t skip this step.

– Avoid deals that look “too good to be true”—they almost always are.

6. Collaborate with Trusted Developers & Agents

To access prime properties confidently:

– Partner with developers known for track records and regulatory compliance.

– Consider off-plan property investments to buy in early and benefit from built-in appreciation—just research the developer well.

– Use professionals for guidance on documentation, title searches, and logistics.

7. Structure a Robust Exit Strategy

Every property needs a purpose within the portfolio:

– Hold & Rent

– Flip after development

– Land Bank for long-term sale

– Determine exit plans early and manage each property according to lifecycle strategy.

8. Use Technology and Build Networks

Smart investors win with tools and connections:

– Use virtual property tours, property listings platforms, and portfolio tracking tools to streamline operations.

– Network with investor communities, agents, and developers—this can open doors to exclusive deals and early insights.

9. Avoid Common Pitfalls

Save yourself from regret:

– Don’t skip legal verification—titles must be clean and valid.

– Steer clear of overpriced or underserved zones; check infrastructure and masterplans.

– Watch for hidden costs—like dues, delayed utilities, or structural issues in new builds.

10. Keep Evolving Your Strategy

Stay adaptive and informed:

– Monitor trends, infrastructure updates, and real estate data—2025 budgets and new rail lines drastically influence returns.

– Adjust your portfolio by redeploying capital from lower-performing assets to rising hotspots ﹣ perhaps reinvest yields into high-growth land zones.

Conclusion

A smart Abuja property portfolio isn’t a random collection—it’s a curated, balanced mix designed for both income and capital growth. By diversifying across asset types and locations, focusing on yield and appreciation, conducting rigorous due diligence, and leveraging expert partnerships, your investments can flourish.